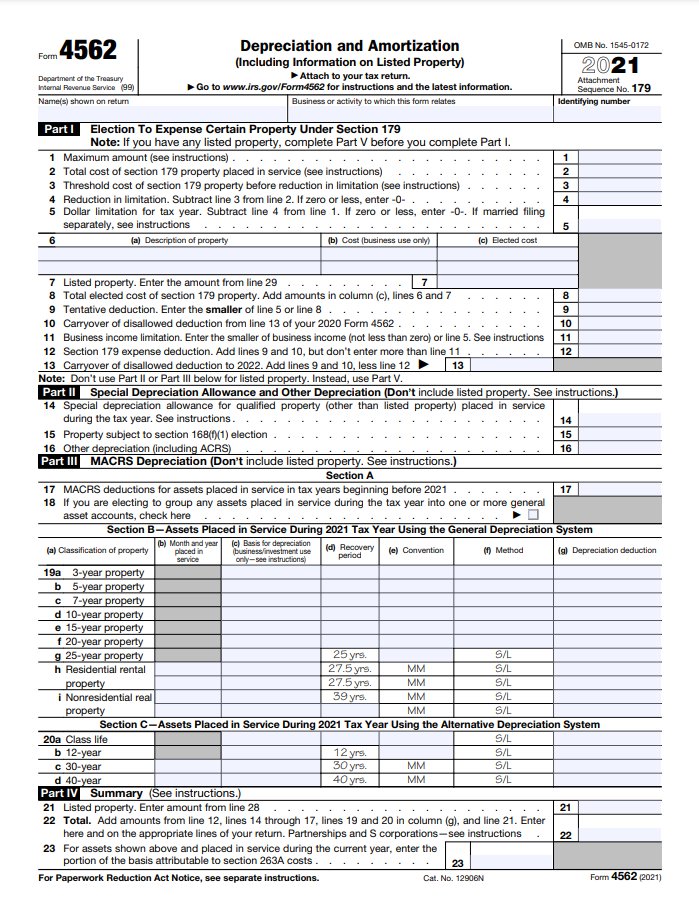

modified business tax return instructions

Select the available appropriate format by clicking on. For Modified Business Tax you should also contact the Department of Employment Training and.

Client Communications E File And Paper File Options Drake19

204 rows An applicant requesting to change its accounting method under DCN 33 change to overall cash method for a qualifying small business taxpayer for a tax year beginning before.

. Pick the document template you need from the collection. The base erosion minimum tax amount for the tax year is the excess of 10 5 in the case of a tax year beginning in 2018 of the modified taxable income of the applicable taxpayer for the. How you can complete the Nevada modified business tax return form on the web.

Write the word AMENDED in black ink in the upper right-hand corner of the return. For purposes of the PTC household income is the modified adjusted gross income modified AGI of you and your spouse if filing a joint return see Line 2a later plus the modified AGI of. This is the easiest way to electronically fill out the forms and prevent losing any information that youve entered.

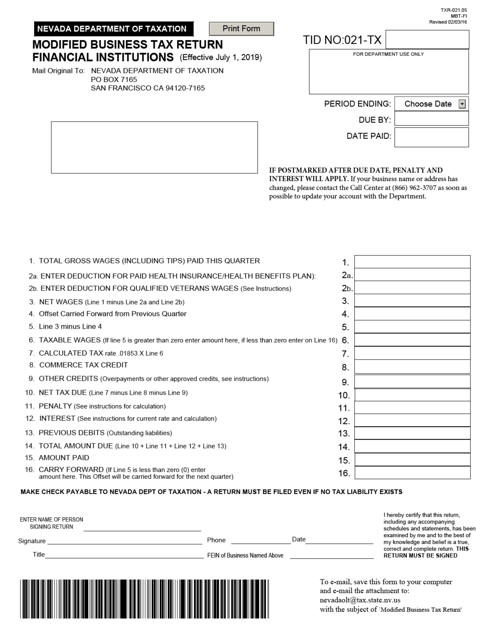

Call 800-829-3676 to order prior-year forms and. The maximum section 179 deduction limitation for 2021. The modified business tax covers total gross wages less employee health care benefits paid by the employer.

The amended return must include any resulting adjustments to taxable. INSTRUCTIONS - MODIFIED BUSINESS TAX RETURN - GENERAL BUSINESSES ONLY Financial Institutions need to use the form developed specifically for them TXR-02104 IF YOU. Line-through the original figures in black ink.

This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. Sign Online button or tick the preview image of the blank. A corporation that does not file its tax return by the due date including extensions may be penalized 5 of the unpaid tax for each month or part of a month the return is late up to a.

Quarter ended September 30 return is due by October 31 Late filing penalty up to 10 NRS 360417 Interest is calculated at 75 per month on the unpaid tax balance NRS 360417. Include a copy of the original return 2. Go to IRSgovOrderForms to order current forms instructions and publications.

Commerce Tax Remittance PO Box 51180 Los Angeles CA 90051-5480 Overnight Mailing. Understanding the Nevada Modified Business Return and Tax Form. This form does not close or cancel any other state or local registrations.

Fill out Modified Business Tax Return General Businesses Form within a few minutes following the recommendations listed below. Commerce Tax returns with Payment Nevada Department of Taxation ATTN. The amended return must be filed within the time prescribed by law for the applicable tax year.

As in most states ever employer subject t the states unemployment compensation law is subject to a Modified. The documents found below are available in at least one of three different formats Microsoft Word Excel or Adobe Acrobat PDF. To get started on the blank use the Fill camp.

Total gross wages are the total amount of all gross wages and. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as. Ordering tax forms instructions and publications.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Federal Solar Tax Credits For Businesses Department Of Energy

Don T Leave Money On The Table Employee Retention Credit Modified And Extended

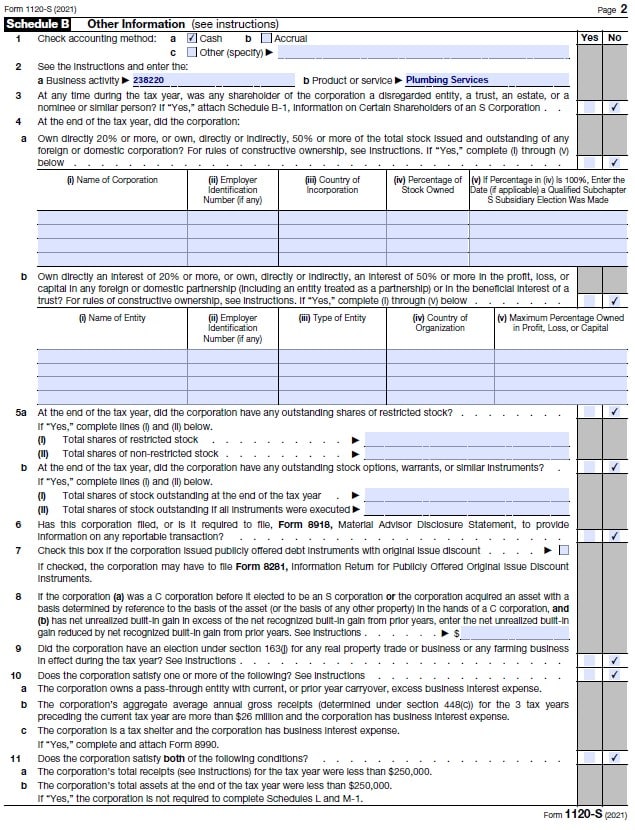

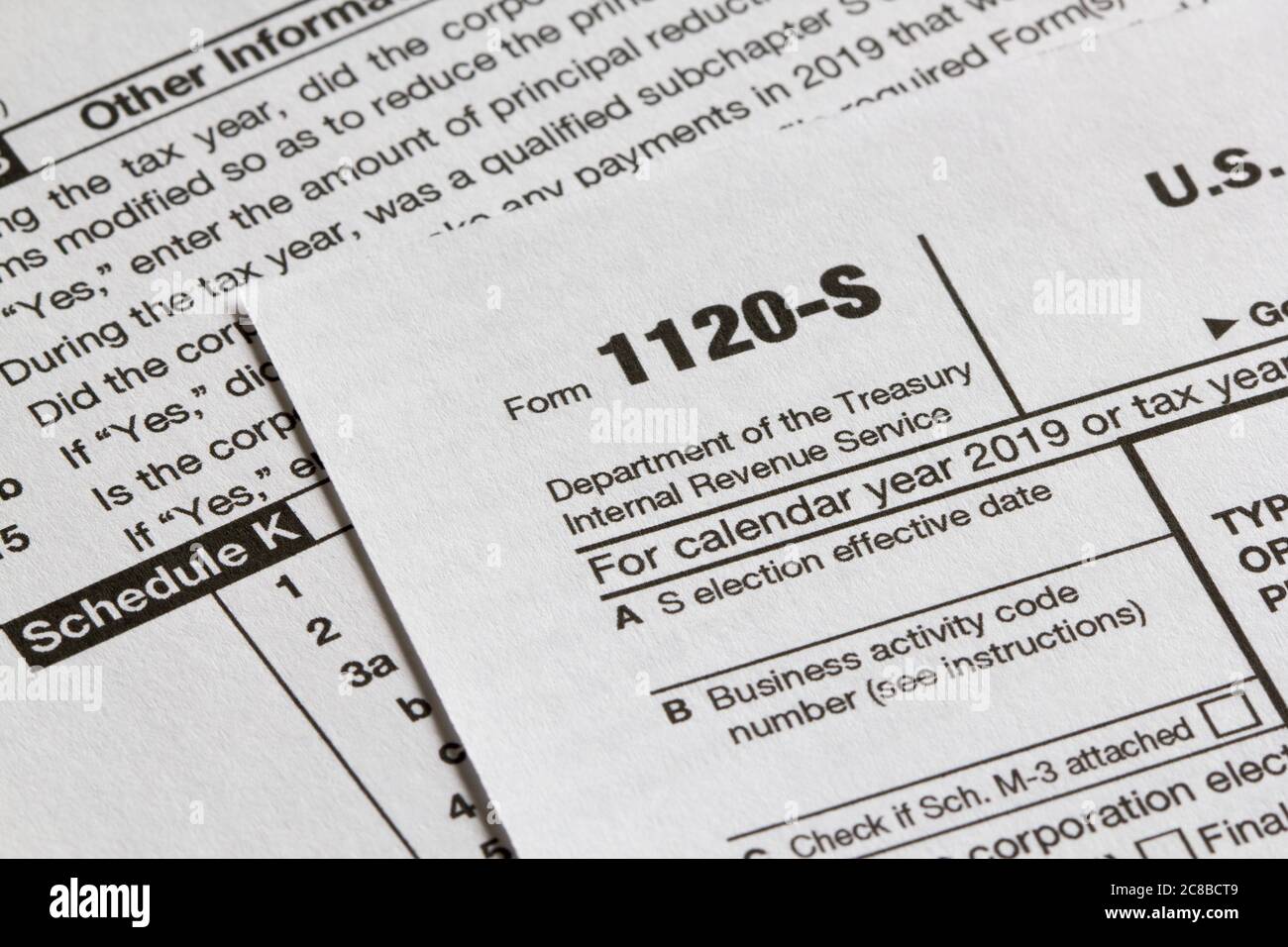

How To Complete Form 1120s Schedule K 1 With Sample

Tax Form Templates 5 Free Examples Fill Customize Download

:max_bytes(150000):strip_icc()/1099-C-69a52b42698048d68609c2c79946530d.jpg)

Form 1099 C Cancellation Of Debt Definition And How To File

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Freetaxusa 2022 Tax Year 2021 Review Pcmag

Form 1120 S U S Income Tax Return For An S Corporation Stock Photo Alamy

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

Sec 199a And The Aggregation Of Trades Or Businesses

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

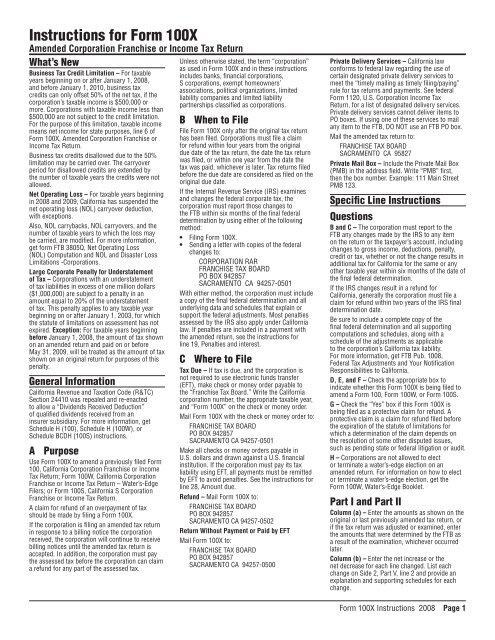

Instructions For Form 100x California Franchise Tax Board

Dor Unemployment Compensation State Taxes

New Irs Announces 2018 Tax Rates Standard Deductions Exemption Amounts And More

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online